How to Get a Mortgage (and the Lowest Possible Rate)

Securing a mortgage is a significant step towards achieving the dream of homeownership. However, the process can seem daunting, especially for first-time buyers. One of the most critical aspects of obtaining a mortgage is securing the best possible rate. In this guide, I'll walk you through the

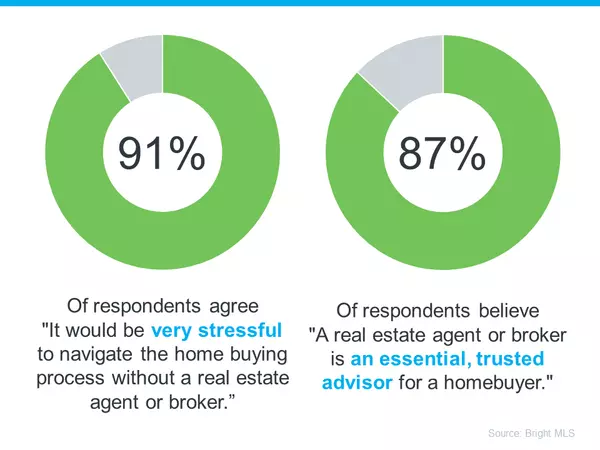

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing. But here’s the thing you really need to know – expert advice from a trusted real estate agent is priceless, no

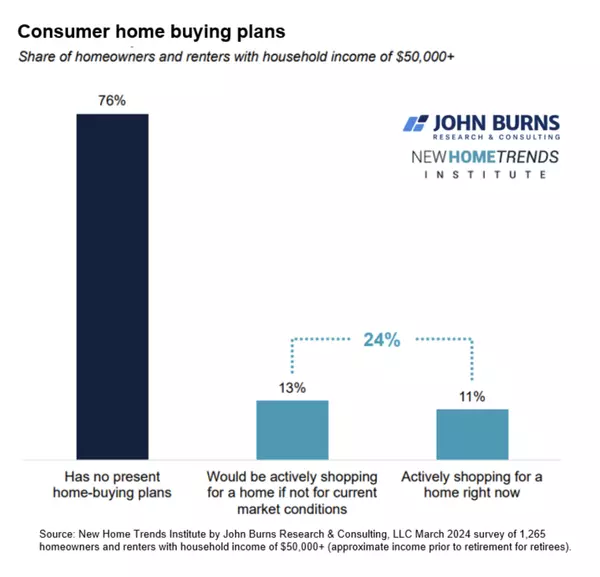

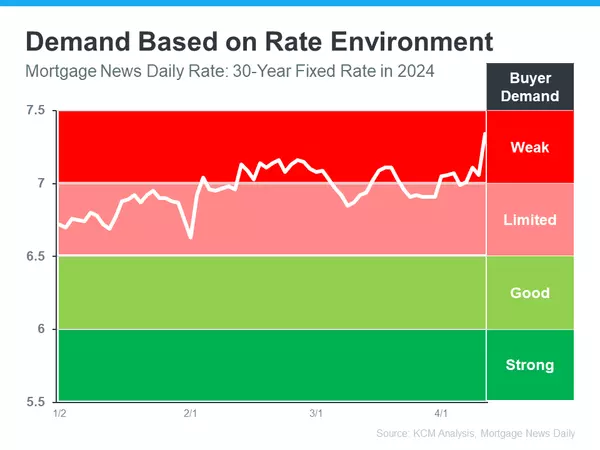

Should I Wait for Mortgage Rates To Come Down Before I Move?

If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you. In the housing market, there’s a longstanding relationship between mortgage rat

Categories

Recent Posts